This Month in WOA #11

SPACs, Stablecoins and Summer Roundtable with our Greater Bay Area Members

Hello,

Welcome to the World of Allocators newsletter — where every trade deal is a win and every tariff is exempt.

Scroll below to stay updated on all things WOA:

Upcoming Events - what’s new

Recent Recaps - what you missed

Content Picks - our favorite articles & podcasts

As always, our goal is to foster learning, sharing, and connectivity across the asset management industry in Asia Pacific and beyond — we look forward to hearing your feedback and suggestions to keep this community thriving!

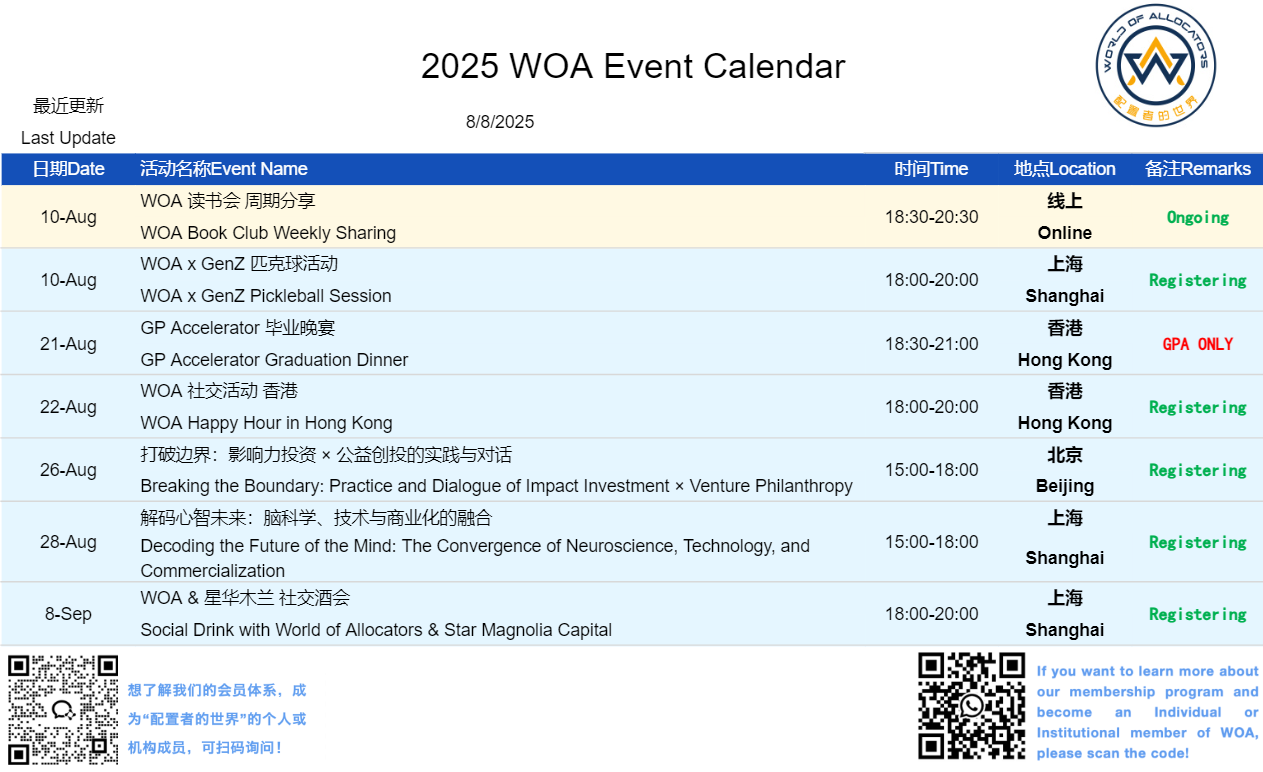

Upcoming WOA Events

WOA Beijing: Philanthropy, Venture Investment, and Impact Investing in Children's Mental Health

🗓 August 26th, 2025 ⏰ 15:00-18:00 📍Beijing

WOA Shanghai: Decoding the Future of the Mind: The Convergence of Neuroscience, Technology, and Commercialization

🗓 August 28, 2025 ⏰ 15:00-18:00 📍Shanghai

Questions? Want to attend an event? Contact Ella Wu at wuenhui@zibencac.com for more info and RSVP.

Recap of Last Month's Events

Here’s what you missed…

7.9 WOA Shanghai: Private Equity Meets NASDAQ

7.11 WOA Beijing: Turning the Wheel of History: Stablecoins and RWA—From Hong Kong to the World

7.12 WOA GBA: Summer Roundtable

Details on the four panels:

On China

(Featuring HongWei C., Managing Partner of FCAP)

🔹 Easy beta is over; alpha sits in complex carve-outs and divestures, particularly in enterprise tech. This requires deal structuring expertise and sector know-how to unlock value.

🔹 Neutral capital becomes a differentiator. International funds can access special situations that RMB funds can’t. This positions them as preferred partners in strategic buy-outs where long term, cross-border objectives are key.

⚛️ On Quantum Computing

(Moderated by Josephine Wu, WOA GBA Chair)

🔹 "Quantum Mechanics is the operating system of the world": Classical computing is built on 18th–19th century classical science. Quantum computing leverages nature’s actual mechanics—superposition and entanglement—to solve classically intractable problems in chemistry, materials, and cryptography.

🔹 The First Killer Apps will be B2B, not B2C: Material science, drug discovery, and encryption-breaking simulations are the early drivers. Consumers won’t feel it directly, but industries will be rebuilt from the inside out.

🏜️ On The Middle East

(Moderated by Jonathan Rechtman, WOA Partner, ft. Joanne Cheung, Senior VP at Global Connectivity Capital Investment (GCCVest))

🔹 "MENA for MENA" Is the New Mandate: Sovereign and family office capital is no longer chasing yield alone—they demand tech transfer, job creation, and onshore value chains. If you're not contributing to local economic sovereignty, you're not getting funded.

💱 On Stablecoins

(Moderated by Josephine Wu, WOA GBA Chair, ft. Teong Hng, Co-founder of Satori Research)

🔹 Stablecoin rails now move USD 27 T—outpacing Visa + Mastercard—splitting payments from deposits and opening a $1 T custody‑liquidity play to onboard TradFi’s next billion users.

🔹 Peer-to-peer stablecoins erode bank deposits; asset-backed yield tokens—including tokenised gold—offer new cross-border rails and attract value beyond traditional USD channels.

WOA Book Club

Our WOA Book Club continues to read great books and discuss them online every Sunday. It’s a great way to dive deep into new ideas, share perspectives, and grow intellectually. We just completed The Almanack of Naval Ravikant: A Guide to Wealth and Happiness by Eric Jorgenson.

Contact us to learn more and join!

Community Announcement

WOA is going global.

We are excited to announce that we will be launching our Rest of World Chapter, coming this fall. This exciting expansion moves WOA beyond our established local network chapters, connecting members worldwide. Though our roots began in the Asia-Pacific region, our intiative is to foster connectivity and exchange among all WOA members on a global scale.

We invite you—our readers—to nominate outstanding candidates, express your interest in joining the chapter, or share any ideas you’d have for us and the initiative.

For more details on the vision, structure and objectives of our new RoW chapter, please see the attached information:

We look forward to hearing from you.

Recommended Articles and Podcasts

Here are a few favorite content picks from our partners and members this month:

From WOA Director Jonathan Rechtman

This is one of those articles that, once you've read, you can't un-read; and afterwards it's hard to look at big VC names the same. Enjoy at your own peril!

From WOA Singapore Chapter Member Sudhanshoo Maroo

From WOA Director Shinya Deguchi

I found Tim Sullivan’s recent interview on Capital Allocators unusually insightful. It captures just how unconventional—yet resolutely long-term—Yale has been in its approach to private equity, spanning both buyouts and venture capital. Sullivan spent an extraordinary 40 years at the endowment office, a tenure almost unheard of in the investment world, sustained by a sense that under David Swensen’s guidance, Yale was the place where he could maximize his potential.

When Sullivan arrived in the early 1980s, the endowment office was just 12 people in an old building without air conditioning—half of them not even focused on investments—and Yale’s venture and buyout allocations together were barely 2% of the portfolio. Yet the university already had relationships with a handful of top venture firms like Sequoia and Kleiner Perkins, and the timing was fortuitous: the first venture boom was underway, and Yale’s willingness to lean in while others were retreating laid the foundation for decades of extraordinary results.

Sullivan recounts how the team favored buyout managers who brought genuine operating expertise, not just financial engineering, and how they made a habit of knocking on doors when few others were paying attention. His stories range from the dot-com boom—when every idea could raise millions in days—to the discipline needed when buyout valuations crept ever higher. The through-line is one of patience, focus on people, and a refusal to be swayed by fashion.

For allocators, young and old alike, the episode is a masterclass in compounding capital over the long term. I listened to it three times, word-for-word, to absorb the lessons.

That’s all for now!

Watch this space for many more exciting developments to come — in the meantime, that’s it for this month’s newsletter. Please reply or comment with your feedback, and see you soon at the next WOA event!